How timely is it updated for tax law changes?

TaxMode has a decent track record for updating its computations. Recent example – the latest tax reform, 2017–2018 Jobs Cuts and Jobs Act was enacted late in December 2017; the updated versions for iOS and Android were released within a week containing a thorough implementation of the new tax law.

Who Uses TaxMode?

Anyone needing quick or in-deapth tax computations for US income taxes. Ideal for what-if analysis of available options for income and deductions before committing to a tax return or handing numbers over to a return preparer.

Average Ratings

Reviews-

Overall

-

Ease of Use

-

Customer Service

TaxMode Details

-

Overview

-

Using TaxMode

-

Computations

-

FAQs

-

App website

-

CostFree. In-app premium features.

About TaxMode

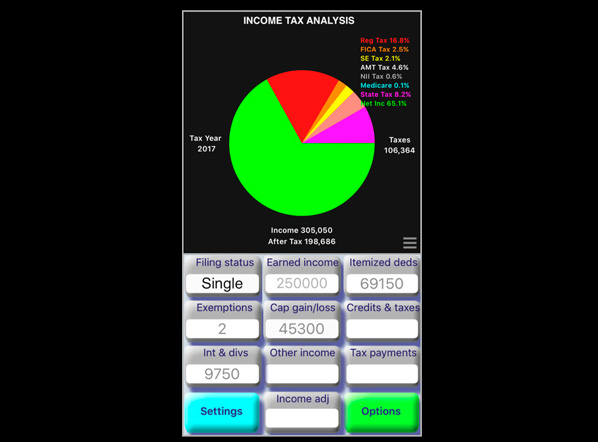

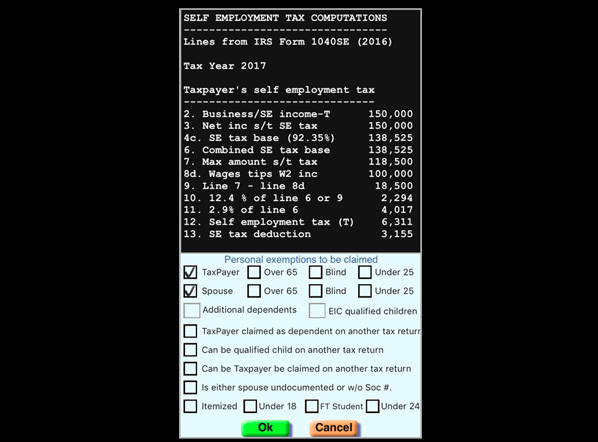

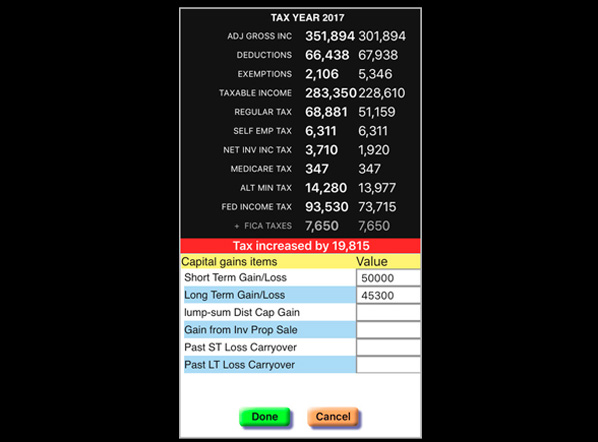

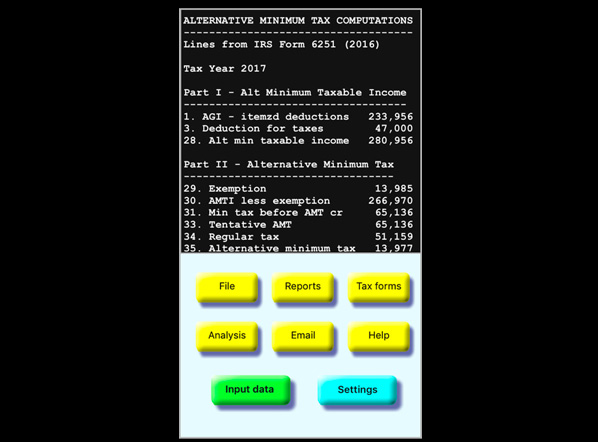

This US income tax calculator is designed to satisfy the advanced tax computation needs of a financial planner and yet it is simple enough to be used for a quick tax calculation by a casual user for personal use. TaxMode is a quick and efficient app for income tax planning. It provides an easy way to compute taxes and perform what-if analysis. The app contains tax computations for three years which generally is previous year, this year and and coming tax year.It contains detailed implementation of the latest USA tax laws. TaxMode’s capabilities can satisfy almost any level of need for tax computation, planning and analysis. In its latest version for tax year 2018 TaxMode it provides a good platform for analyzing the new deduction for the pass-thru income of qualified business addressing both category of trade and service business as defined in the 2018 tax law - Specified and Non-specified trade or business. This app can especially be helpful for taxpayers filing quarterly estimated taxes. It provides the necessary computations and can display supporting results corresponding to the IRS tax return forms. It automatically checks for the applicability of different taxes based on your data and displays them interactively in an easy to understand format. If you need to review how it computed a given tax, just tap on the numbers and it provides detailed computations that resulted in the displayed tax amount. The computation flow for each type of tax can also be viewed as line-by-line values that correspond to the latest IRS tax forms. The breakup of each applicable tax as compared to the overall tax can also be displayed graphically as a pie chart. This app can be a valuable tool for professionals and nonprofessionals alike. For a tax professional it will enhance your analytical ability, improve your day to day productivity and make tax planning more efficient. For an independent individual, it provides an easy to use tool to analyze the tax impact of a transaction in terms of taxes saved or increase in tax liability, calculate a quick year-end tax estimate, perform a pre-tax-return-filing analysis, or review the impact of any other tax related investment decision. TaxMode is a solid income tax planning app.

TaxMode Reviews

Excellent income tax calculator!

Likely Extremely

Likely

Pros: Quick and easy income tax calculator, extensive tax computations built-in, provides detailed backup for displayed tax results. Provides what-if functionality in the same year or across two tax years.

Cons: Does not prepare tax return.

Overall: This is a great tax app. Underneath its simple result display and a nice pie chart showing elements of income and tax there seems thorough implementation of income tax computations. All types of taxes are computed automatically if they are applicable based on the data entered. It provides computational details when you tap on any number on the result display. It will show the corresponding IRS form detailing how the tax amount was calculated. Input is simple and straight forward, results are instantaneous and, generously, they have included 3 years of tax computations; current tax year along with the prior and upcoming tax years.

Recommendations to other buyers: You will need another application for preparing income tax return. This app, although it shows key results for major IRS tax forms, does not prepare a tax return. Limited to US taxes only.